Debt recycling is a financial strategy that can help individuals build wealth and secure a stable financial future. By understanding the concept of debt recycling, the mechanics behind it, and the risks and benefits associated with this strategy, individuals can make informed decisions about implementing it in their own lives.

Understanding the Concept of Debt Recycling

Debt recycling involves strategically leveraging your home equity to invest in income-producing assets. The idea is to convert bad debt, such as a mortgage or personal loan, into good debt recycling example, which generates income or appreciates in value over time. This method allows homeowners to use their existing assets to generate wealth and build financial security.

Imagine you are a homeowner with a mortgage on your property. You have been diligently making monthly payments, but you start to wonder if there is a way to make your home work harder for you. This is where debt recycling comes into play.

The Basics of Debt Recycling

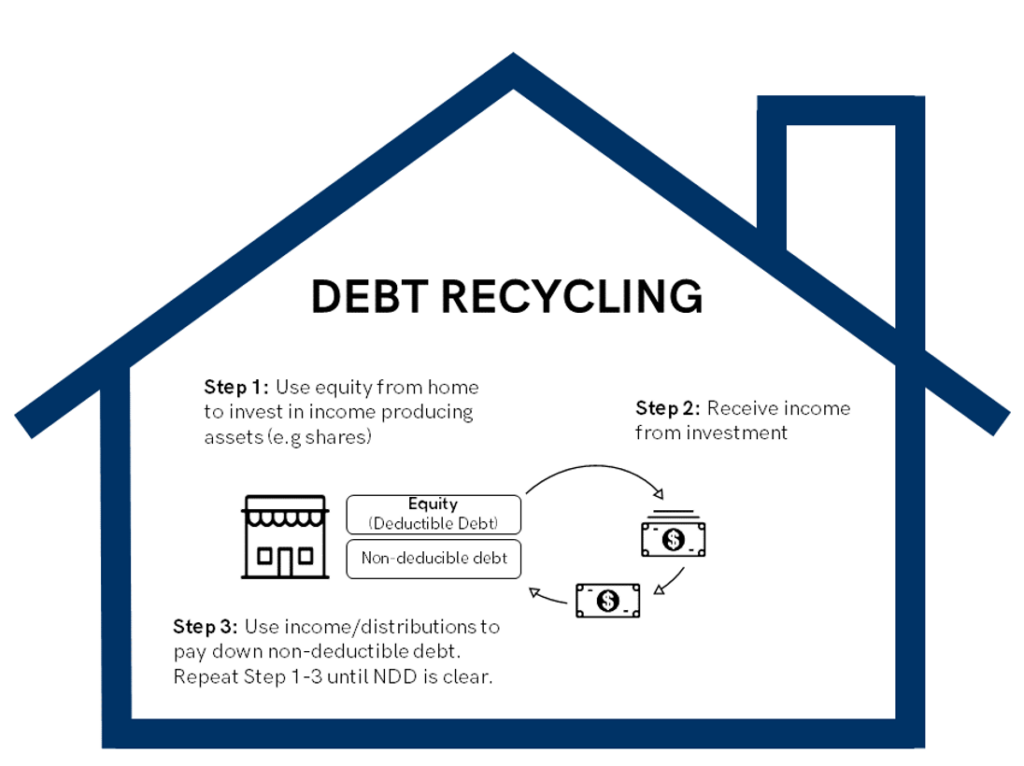

At its core, debt recycling involves three key steps: borrowing against home equity, investing the borrowed funds in income-generating assets, and using the returns from those investments to pay off the original debt. By recycling the debt, individuals are essentially using their home as collateral to access additional funds that can be put to work in the financial markets.

Let’s dive deeper into each step of the debt recycling process:

Step 1: Borrowing against home equity

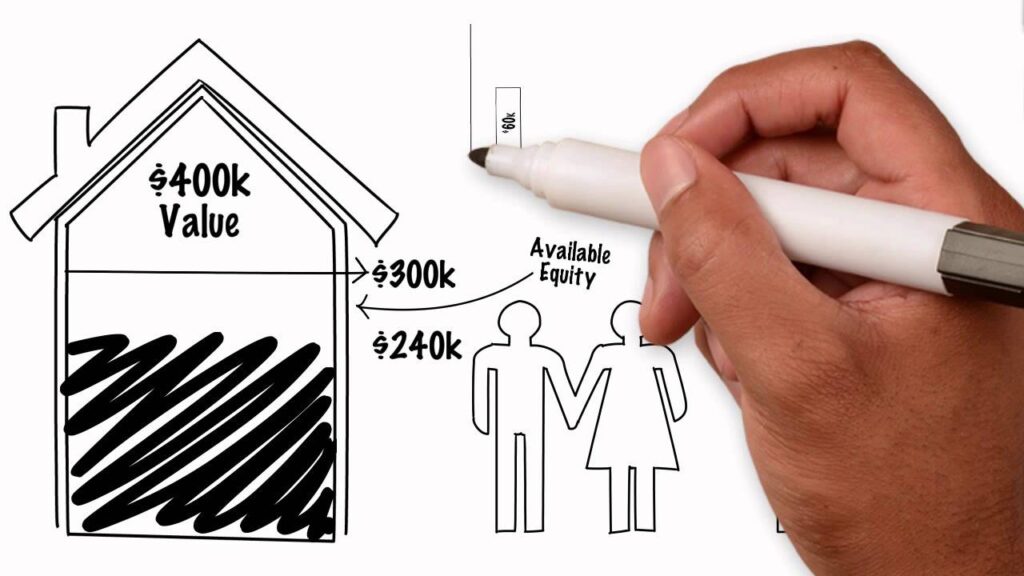

Home equity is the difference between the market value of your property and the outstanding balance on your mortgage. To begin debt recycling, you would need to assess the amount of equity you have built up in your home. This can be done by obtaining a property valuation or consulting with a professional appraiser.

Once you have determined the amount of equity available, you can apply for a loan or line of credit secured against your home. This loan will provide you with the funds needed to invest in income-generating assets.

Step 2: Investing in income-generating assets

With the borrowed funds in hand, it’s time to identify suitable income-generating assets to invest in. These assets can include stocks, bonds, real estate, or even a small business. The key is to select investments that have the potential to generate regular income or appreciate in value over time.

It’s important to conduct thorough research and seek professional advice when choosing your investments. Diversification is also crucial to mitigate risk and maximize potential returns.

Step 3: Using investment returns to pay off the original debt

As your income-generating assets start to generate returns, you can allocate a portion of those earnings towards paying off the original debt. This can be done by making additional mortgage payments or reducing the outstanding balance on any other loans you may have.

By consistently reinvesting the returns and using them to pay down debt, you are effectively recycling your debt into assets that have the potential to appreciate in value and generate even more income.

How Debt Recycling Differs from Debt Consolidation

While debt recycling may sound similar to debt consolidation, the two strategies are fundamentally different. Debt consolidation involves combining multiple loans into a single loan with a lower interest rate or more favorable terms. It aims to simplify debt management and potentially reduce monthly payments.

Debt recycling, on the other hand, focuses on utilizing existing assets to generate additional income and reduce overall debt burden. It is a proactive approach that leverages the potential of income-generating investments to create wealth and financial security.

By understanding the difference between debt recycling and debt consolidation, you can make informed decisions about which strategy aligns best with your financial goals and circumstances.

The Mechanics of Debt Recycling

The effectiveness of debt recycling hinges on the role of home equity in the process and the ability to convert bad debt into good debt.

The Role of Home Equity in Debt Recycling

Home equity plays a crucial role in debt recycling as it serves as collateral for borrowing funds. The value of your home serves as security for lenders, allowing you to access funds at a competitive interest rate. This means that the more equity you have in your home, the more borrowing power you have. It’s like having a financial safety net that can be tapped into when needed.

When you borrow against your home equity, you can seize opportunities to invest in income-generating assets. This can include purchasing shares in well-established companies, investing in managed funds that have a proven track record of delivering solid returns, or even acquiring rental properties that can provide a steady stream of rental income. By leveraging your home equity, you are able to diversify your investment portfolio and potentially increase your overall wealth.

Furthermore, borrowing against your home equity often comes with lower interest rates compared to other forms of borrowing, such as credit cards or personal loans. This can result in significant interest savings over the long term, making debt recycling an attractive strategy for those looking to optimize their financial situation.

The Process of Converting Bad Debt into Good Debt

The success of debt recycling lies in converting bad debt, such as a mortgage or personal loan, into good debt that generates income or appreciates in value. By strategically investing the borrowed funds in assets like shares, managed funds, or rental properties, individuals can generate returns that can be used to pay down the original debt while simultaneously building wealth.

When it comes to converting bad debt into good debt, careful consideration must be given to the choice of investments. It’s important to conduct thorough research and seek professional advice to ensure that the investments align with your financial goals and risk tolerance. For example, investing in blue-chip stocks with a history of stable dividends can provide a reliable income stream, while investing in real estate can offer both rental income and potential capital appreciation.

Additionally, it’s crucial to regularly review and monitor your investments to ensure they continue to perform as expected. This involves staying up-to-date with market trends, analyzing financial reports, and making adjustments to your investment strategy when necessary. By actively managing your investments, you can maximize the returns generated from your borrowed funds and accelerate the process of debt reduction.

It’s worth noting that debt recycling is not a one-size-fits-all solution and may not be suitable for everyone. It requires discipline, financial knowledge, and a long-term perspective. Before embarking on a debt recycling strategy, it’s important to assess your personal circumstances, consult with a financial advisor, and carefully weigh the potential risks and rewards.

Benefits of Debt Recycling

Debt recycling offers several advantages for individuals seeking to build wealth and secure their financial future.

Debt recycling is a powerful strategy that can help individuals achieve their financial goals by leveraging their existing debt to generate wealth. By understanding the potential benefits of debt recycling, individuals can make informed decisions about their financial future.

Potential for Wealth Creation

One of the primary benefits of debt recycling is the potential for wealth creation. By investing in income-generating assets, individuals can generate returns that surpass the interest costs associated with their debt. This means that individuals can effectively use their debt to build wealth over time.

When individuals strategically invest in assets that have the potential to generate income, such as stocks, real estate, or businesses, they can benefit from the compounding effect of their investments. As the investments grow, the returns generated can exceed the interest costs of the debt, leading to substantial wealth accumulation.

For example, let’s say an individual has a mortgage with a low-interest rate. Instead of solely focusing on paying off the mortgage, they could use the extra funds to invest in income-generating assets. Over time, the growth of these investments can outpace the interest costs of the mortgage, resulting in a net gain and increased wealth.

Tax Efficiency and Debt Recycling

Another significant advantage of debt recycling is the potential tax benefits it offers. In many countries, the interest on investment debt is tax-deductible, providing individuals with a valuable tax advantage.

By leveraging debt recycling, individuals can reduce their overall tax liability while simultaneously building wealth. This is because the interest costs associated with the debt used for investment purposes can be deducted from the individual’s taxable income. As a result, individuals can effectively lower their tax bill, allowing them to allocate more funds towards their investments.

Furthermore, the tax benefits of debt recycling can be particularly advantageous for high-income earners. By strategically managing their debt and investments, individuals can optimize their tax position and potentially save a significant amount of money in taxes.

It is important to note that the tax implications of debt recycling can vary depending on the individual’s jurisdiction and specific circumstances. Therefore, it is crucial for individuals to consult with a qualified tax professional or financial advisor to ensure they understand the tax implications and benefits of debt recycling in their specific situation.

In conclusion, debt recycling offers individuals the opportunity to build wealth and secure their financial future. By strategically leveraging their existing debt and investing in income-generating assets, individuals can potentially generate returns that surpass the interest costs associated with their debt. Additionally, the tax benefits of debt recycling can further enhance the financial advantages of this strategy. However, it is essential for individuals to carefully assess their financial situation and seek professional advice to determine if debt recycling is suitable for their specific circumstances.

Risks and Considerations in Debt Recycling

While debt recycling can be a powerful wealth-building strategy, it is crucial to consider the associated risks and exercise financial discipline throughout the process.

Market Risks and Economic Factors

Like any investment strategy, debt recycling is not without risks. The performance of income-generating assets is subject to market fluctuations and economic factors. It is essential to conduct thorough research and seek professional advice to mitigate these risks and make informed investment decisions.

The Importance of Financial Discipline

Debt recycling requires financial discipline to ensure that funds are invested wisely and returns are used to pay off the original debt. It is important to resist the temptation to spend the borrowed funds on non-income-generating assets or unnecessary expenses. Maintaining strict financial discipline is crucial to the success of the debt recycling strategy.

Implementing a Debt Recycling Strategy

Implementing a debt recycling strategy requires careful planning and attention to detail. Here are the steps to get started:

Steps to Start Debt Recycling

- Evaluate your current financial situation, including your assets, liabilities, and income.

- Assess the potential for debt recycling based on the available home equity and borrowing capacity.

- Consult with a qualified financial advisor to determine the most suitable income-generating assets for your investment strategy.

- Borrow against your home equity and invest the funds in the selected assets.

- Monitor the performance of your investments and diligently use the returns to pay down the original debt.

Seeking Professional Advice for Debt Recycling

Given the complexities and potential risks associated with debt recycling, it is highly recommended to seek professional advice. A qualified financial advisor can provide personalized guidance based on your individual circumstances and help you navigate the intricacies of debt recycling with confidence.

Debt recycling can be a powerful strategy for building wealth and achieving a solid financial future. By understanding the concept, mechanics, and potential risks and benefits, individuals can make informed decisions and implement a debt recycling strategy that aligns with their financial goals. With careful planning, discipline, and professional guidance, debt recycling can pave the way to financial security and prosperity.

Related: The Role of Debt Recycling in Financial Planning

Tags: ato debt recycling, debt recycling australia, debt recycling example, debt recycling explained, debt recycling strategy, how does debt recycling work, is debt recycling worth it, what is debt recycling